Starting out in business and getting financed in the right way for you – Lawrie Chandler

9 September 2021When you’re starting out in business, it can be pretty difficult to navigate the business landscape. Looking at it from a finance perspective can add another layer of complexity. Critically, businesses thrive or die based on cash. The topic of finance is central to a business in terms of its planning, performance, and its future trajectory.

This blog outlines some of the key principles of financial planning when starting out with business, especially after the pandemic. The economy has reopened, and trading is a lot easier for most businesses, though challenges remain within this new environment. That means that getting funding is actually very difficult. It takes a little bit of work to ensure that you are looking in the right places and doing the right things. You also need some skill to ensure success when applying for the different forms of funding.

The landscape of funding businesses has massively changed from the emergency business support of 2020. The focus now in 2021 is on adapting and recovery and the funding available now links to these two areas.

Getting going towards finance

When starting out in business our philosophy is KISS. Keep It Super Simple.

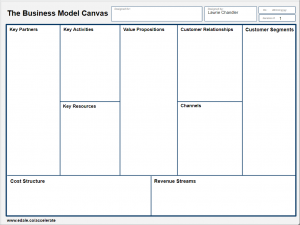

It’s also important to start small – this is known as using ‘lean processes’ in business speak. It just minimises expenses and the cost of operations while you find your feet. Having a clear focus on your business proposition and what you want to do (so you don’t get distracted at this early stage) will also help you in marketing and reaching your customers. Starting out doesn’t require masses of business planning but the use of a few resources like one page financial models, one page business plans and a canvas called the Business Model Canvas can be super helpful.

When we talk about ‘canvas’ what we mean here is a blank piece of paper. Just like an artist canvas it is a frame that is blank and to be worked upon to create your masterpiece.

When going into business and planning your journey there are different ways that you can start and different ways to think about it. You can think about it as building a rocket ship and take very clear steps with excruciating detail or take the “just do it” approach to getting started, with no plans, no route, nothing. The third way is what we recommend: consider business planning like driving a car. You set a hypothetical path to reach a destination, but you could change it along the route. Adapt and find the best way to get to where you need to go. Our view when actually doing business planning and financial planning is to do what helps you but, like driving a car, you change speed and route as you go along.

Business model Canvas

The business model canvas is a one page tool to develop a business. There are lots of videos on how to do the business model canvas. Here we give you a little insight into the financial elements of the business model canvas. The left-hand side covers all of the input costs of the business. The right-hand side covers all the areas that generate revenue and sales. Because these are the things that you do not control, they can seem more daunting to focus upon. This video demonstrates how the business model canvas can actually be used for financial planning and developing a business concept. This photo demonstrates how the business model canvas can look when focusing on the revenue side and customers for a fictional cupcake making business.

Understanding cash in a business

With a business proposition taking shape in the Business Model Canvas, it is now easier to focus on how you could do a little bit of financial planning to develop the business concept.

The core reality of doing business is that businesses only fail because they run out of cash. Organisations do not fail because of a lack of energy or enthusiasm. No cash means no business.

We encourage the businesses we advise to focus on having cash, making cash, reducing burn and increasing their runway. Let me explain:

- Burn means ‘how much money you are using normally on a monthly basis’ to get your business going. It’s a little bit like considering cash that you’ve got as being bank notes – how many do you go through or burn each month to keep the business going.

- Runway means ‘how long you have until you run out of cash’. A little bit like a runway for an aircraft take off, how much tarmac do you have before you can’t get off the ground.

Burn and runway are two easy concepts to understand. Having an awareness of them with regard to your cash position and time scales is critical.

When creating a financial plan there are two main elements to focus on – the Cash Flow Statement and also the Profit and Loss. The cash flow statement is the most critical, reflecting the point that if you have no cash you have no business. The easiest way to think of a cash flow statement is it’s like looking at your bank statement; you see how much money you have at the start of the period with debit and credits ie money in / money out and then you have a position at the end of your bank statement. The profit and loss is a descending formula that reflects how much you sell something for, the costs in making that, expenses involved in your business, and finally what you’re left with which is the profit.

The table below shows you a simple example of how to view a cash flow statement and profit and loss.

| Cashflow

Starting cash position + Income from sales + Grants + Loans + Capital investments – Costs from operations = End of cash position |

Profit and loss

Sales – Cost of Good Sold (COGS) = Gross Profit – Marketing expenses – Operating expenses – Administrative expenses = Net Profit |

There is a full hour and a half webinar covering this topic and giving you more details and signposting some to some funding pots that could help you in starting out your business following the pandemic. Take a look here.

This blog is designed to give you a basic introduction to the things you’ll need to think about in developing your financial plan and business proposition. The Business Gateway are running a variety of webinars on access to finance and you can find out more here.